Securing Working Capital as Larger Enterprises Extend Payment Terms

As larger companies take longer to pay suppliers, US Capital Global is structuring and providing optimal financing for lower middle market businesses in need of working capital.

Access to working capital can make the difference between simply having dire issues of liquidity and thriving through increased sales and business expansion. Increasingly, larger enterprises, especially in the consumer goods industry, have been lengthening supplier payment terms significantly—sometimes to as long as 120 days or even longer—to actively manage their cash conversion cycles. While this of course improves cash flow at the buying company, it puts significant financial strain on smaller suppliers, making it difficult for them to meet operational needs or invest in their own growth.

Smaller Businesses Struggle with Fluctuating Cash Flow

Cash-flow forecasting remains as difficult as ever for lower middle-market suppliers. Not getting paid on time by clients and customers is one of the biggest challenges smaller companies face when managing their cash flow.

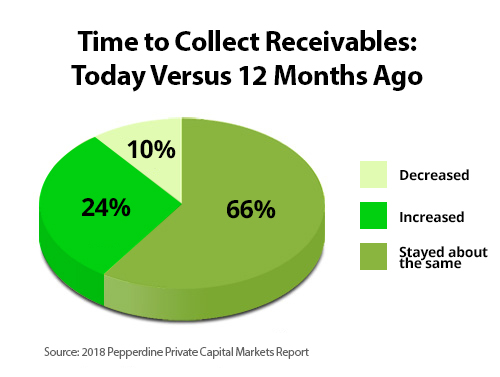

According to a survey by Pepperdine University, nearly one in four companies (24%) have reported an increase in the time it takes to collect receivables compared to twelve months earlier. As a result, many of these companies have struggled or been unable to grow, while some have even had to cut back on employee numbers.

Getting the Working Capital Your Business Needs

This strategy of delaying payments to suppliers began in the recession and has worsened over the years. It places enormous stress on smaller businesses, which often don’t have the bargaining power to address the problem. The good news is that these businesses actually have more financing options available to them than ever before to help them mitigate prolonged collection periods. US Capital Global specializes in providing intelligently structured financing—either cash-flow term loans, asset-based lines of credit, or both—to provide help quickly for businesses in this situation.

How US Capital Global Has Helped Clients

For instance, the US Capital team structured and provided a non-traditional, flexible $10 million accounts receivable and inventory line of credit for MusclePharm Corporation, a global market-leader in the sports nutrition industry. Similarly, the US Capital team structured and provided a $2 million accounts receivable line of credit for Tandon Digital, Inc., which develops and manufactures high-performance flash and other memory storage products under the brand name Monster Digital®.

“We are extremely pleased with this well-structured financing, which was designed specifically to support our rapid business growth,” said Jay Tandon, CEO at Tandon Digital, Inc. “We have been experiencing explosive growth in recent months and needed a working capital line of credit to help meet demand for Monster Digital products from customers such as Fry’s Electronics, Rite Aid, and Staples. This new facility provides the additional working capital the company needs to expand its distribution channels.”

To learn more about how your business can secure the funding it needs, email Jeffrey Sweeney, Chairman and CEO, at jsweeney@uscapglobal.com or call (415) 889-1010